Lecture

One of the important fundamental provisions of effective management is the allocation of functional areas within an enterprise: complexes of the same type of management processes formed on the basis of the unity of macro-objects of management. In a market economy, the most important functional area is finance, since it is here that the overall result of the production and economic activity of the enterprise is finally formed - its income (profit). This provision determines the need to highlight in the general enterprise management system a special subsystem whose functions are focused on the targeted impact on the entire set of monetary relations (finance) of an enterprise - financial management.

In the whole variety of monetary relations of an enterprise, three groups can be distinguished:

Relations with production and business partners, which are suppliers, buyers, intermediaries and creditors. As a result of the company’s interaction with partners, the company’s payment flows (outgoing flows) and in favor of the company (incoming flows) in the form of payment for material and technical resources, various services provided to the company, products and services produced by the company, receipt and repayment of loans and some other .

Relationships of an enterprise with a state, which in most cases are expressed by outgoing flows of enterprise payments to the state in the form of taxes, extrabudgetary funds, customs duties and fees, and some others. In some cases, there are also incoming flows, for example, when an enterprise executes a government order, but in this case, the corresponding governing body (customer) can be considered as one of the partners (buyer).

Relations of the enterprise as a legal entity with its employees, as a result of which there is an outgoing flow of payments in the form of staff remuneration.

A characteristic feature of financial management is that all objects of this type of management activity, without exception, are located in the external environment of an enterprise, even calculations with the collective of an enterprise for a financial manager are equivalent to calculations with other resource providers, since they mean an outflow of funds. This means that the composition of management decisions is dominated by coordination (in relations with partners) and normalized actions (in relations with the state and staff), while the scope of application of administrative methods is very limited.

The purpose of financial management is the rational organization of cash flows of the enterprise, i.e., ensuring the most favorable ratio between the total volumes of their incoming and outgoing components. When this goal is achieved, it should be made clear that in different situations and in different perspectives it can be expressed in different ways.

The strategic time intervals during which the overall feasibility of the activity and existence of the enterprise is determined, the goal is an unconditional positive relationship between revenues and expenditures (respectively, the volumes of incoming and outgoing cash flows), and in a certain normatively given proportion corresponding to the minimum acceptable profitability of the enterprise.

On tactical and operational time periods, when, on the one hand, the current conditions of the enterprise’s operation are changing dynamically (for example, the state of the markets), and on the other, specific production and business tasks are set, it’s acceptable, and often it’s necessary to make decisions that lead to temporary loss ratio. So, for example, this situation arises when implementing programs to capture markets by price competition, while eliminating excess stocks of goods, when mastering the production of new types of products, when capital and current costs rise sharply. In this case, the goal of financial management is not maximizing income, but minimizing losses, reducing them to a really necessary value, which is especially important since these losses should be compensated as soon as possible by an increase in income. Thus, an inextricable link is formed between the strategic and tactical objectives of financial management.

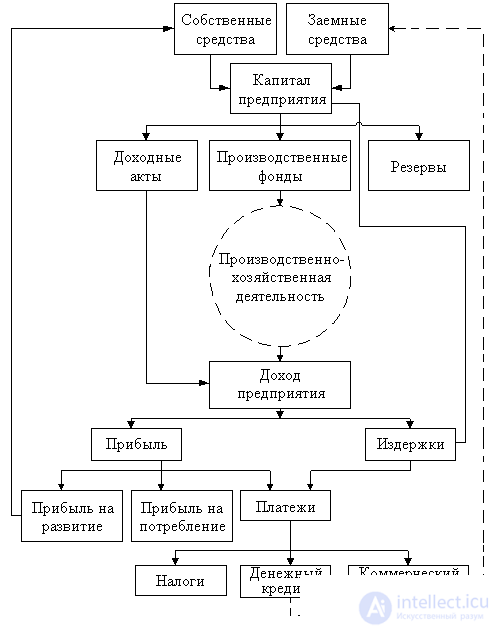

To determine the composition of the tasks that need to be solved to ensure the achievement of these goals, consider the scheme of movement of financial resources of the enterprise - the formation of cash flows shown in Fig. 5.9.

Figure 5.9. The scheme of cash flow of the enterprise (cash flow).

The general financial resources of an enterprise are formed from two sources (hereinafter, the numbers denote individual node elements of the formation of cash flows).

Funds of the owners of the company, who make their contributions to its share capital, acquiring its shares (if the enterprise is a joint-stock company) or shares in it (if the enterprise is a partnership or cooperative). We note here that contributions to capital do not necessarily carry a monetary form and can be tangible and intangible values. At the expense of this source, and later at the expense of profit (see below), the own funds of the company are formed.

Funds of the company's partners, which provide loans to the company in one of the following forms:

Note that if the first two forms of lending represent the physical movement of funds and form an obvious incoming cash flow, the latter allows the company to obtain additional financial resources at its disposal in the form of temporary savings in the cost of paying for supplies.

The aggregate of credits forms the borrowed funds of the enterprise.

Own and borrowed funds form the capital of the enterprise.

During the organization of own and borrowed funds flows, the first task of financial management arises: the formation of a rational financial capital structure. The essence of this task is that it is necessary to determine precisely in what amounts and in what ratio these funds will be consumed by the enterprise to support its activities. The decision to structure the capital of an enterprise should take into account a number of factors that are interdependent and which include:

An effective solution to this problem is possible only if the company has a definite and justified financing policy, which is developed and flexibly changed depending on the state of the financial market - from a policy of relying on its own funds to a policy of maximum borrowing.

Simultaneously with the first, the second task should be solved : the creation of the most attractive conditions for investors , i.e., those that will allow the enterprise to receive both its own and borrowed funds in the required amounts and on acceptable conditions. Solving this task requires financial management:

determine the effective structure of the issuance of securities, first in the context of the relationship between property rights and debt obligations, and then - the relationship between different types and types of the first and second. This means that the volumes of the issue and the terms of the placement of securities are established, which correspond both to the possibilities of the financial market in general and to the requirements of specific potential investors;

determination of effective loan conditions, reflecting the requirements of specific financial and credit organizations - potential lenders to the conditions for issuing loans. Here it is necessary to establish the amount of interest rates acceptable for both the company and the lender, as well as the forms of loan security (material or financial pledge, guarantees of third parties, others).

An important way to solve the problem of creating attractive investment conditions is the careful development of business plans, both regular (annual) and for individual objects and areas of investment.

In general, when solving this task, it is necessary to proceed from the fact that each investor is characterized by his own idea of the permissible ratio between the profitability and the reliability of his investments, i.e., the financial risk associated with them.

The financial resources formed by solving the problems described above form the liabilities of an enterprise, which can be characterized as its financial potential. To effectively realize this potential, it is necessary to rationally organize cash flow in the following areas:

the acquisition of production assets, which are the basis of production and economic activity of the enterprise and include fixed and circulating production assets in the form of equipment, buildings, structures, raw materials, materials, components and other material values, as well as intangible assets in the form of patents , licenses and other forms of information support of the enterprise;

the formation of profitable financial assets of the enterprise, which represent its external investments in the form of the acquisition of securities of the state and other enterprises or in the form of term bank deposits. Such investments allow solving a number of important tasks for an enterprise:

a) to keep inflation-protected through the profitability of these assets accumulation to solve the problems of prospective development;

b) receive a certain and sufficiently stable with a reasonable structure of these assets, additional income;

c) provide additional (relative to production) diversification of sources of income of the enterprise and, consequently, increase its financial stability;

the formation of reserves of the enterprise, representing special funds intended for use in such situations, which are not mandatory components of the enterprise, but with a certain probability may occur. Mainly, such situations are connected with unforeseen circumstances leading to the loss of production assets of an enterprise under the influence of natural or economic factors (natural disasters, abrupt changes in market conditions). It is necessary to take into account that although it is possible to create reserves in the form of stocks in a material form, it is most advisable to make redundancy using financial instruments. It should be noted that, in form, reserves may coincide with income assets, but higher requirements should be placed on their liquidity in order to ensure mobility and dynamic use of them.

For rational organization of cash flows that form production assets, earning assets and reserves, it is necessary to solve the third task of financial management: to develop an objectively rational structure of assets of an enterprise, i.e., such a relationship between non-current (fixed assets), circulating (revolving production assets) and monetary ( financial assets, which will ensure maximum overall efficiency of production and economic activity of the enterprise. The basis of the solution of this problem lies in the peculiarities of the strategy * and the tactics of the development of the enterprise. These features are almost always associated with the action of two factors: the change in the volume of activity, which determines the total need for assets of each type, and the change in the level of enterprise diversification, which determines the subject and financial structure of assets.

The general task of structuring assets is divided into three private ones:

the task of managing long-term investments of an enterprise, as a result of which the solution creates the most effective conditions for financing the creation of property complexes ensuring the production and economic activity of an enterprise in accordance with its necessary volumes and structure; methodically this problem is solved with the help of investment planning with the calculation of the financial performance of each project;

the task of managing the working capital of an enterprise in order to determine the real need for it (working capital ratio) and the available, most efficient sources of covering this need, primarily through a targeted impact on the volumes of payables and receivables and their terms;

the task of managing the financial assets of an enterprise, the essence of which is to form a portfolio of foreign investments and to continuously regulate its structure in accordance with the current financial market conditions and the adopted investment policy (a set of requirements developed by the company for the sectoral structure of investments and their profitability and reliability).

As a result of solving this task, most of the enterprise’s financial resources are converted into tangible form (production assets), then, through production and business activities, into goods and services produced by the enterprise and, through their implementation, again into money, in the form of the enterprise’s income ( gross revenue). It should be noted that a part of the gross proceeds are receipts from the use of monetary assets and others, such as fines and penalties in favor of the enterprise.

The income of an enterprise includes two parts that are fundamentally different from the point of view of financial management, the allocation of which can be represented in the form of two cash flows - profits and costs.

Profit is a part of the gross proceeds of an enterprise that belongs to its owners and is used in their interests or to fulfill their obligations.

A reasonable distribution of profits is the fourth task of financial management, the solution of which can be represented in the form of solving the following particular tasks:

unconditional, full and timely fulfillment of those obligations of the enterprise to partners and the state, the source of repayment of which is determined in accordance with the legislation profit, which means making appropriate decisions in very narrow limits of the space of their choice; however, certain options are also possible here, for example, in the part of tax payment management;

allocating a sufficient part of the company’s remaining profit after fulfilling its obligations to meet the interests of the owners (payment of dividends) in accordance with their ideas about the return on investment and to meet the interests of the enterprise’s collective (additional payments, social development programs);

the allocation of the necessary funds for the economic and technical development of the enterprise (the acquisition of new and replacement of retired fixed assets, an increase in the working capital ratio), given that the development of the enterprise is one of the most important conditions for organizing reliable and effective partnerships, in particular, obtaining additional borrowed funds.

It must be borne in mind that the multi-criteria of the distribution of profits makes it objectively impossible to make an exact decision, and here, as in many practical situations, financial management * acquires the features of not only science, but also art.

The distribution of profits of the enterprise forms the following cash flows.

Funds allocated from profits to make payments, which, in turn, are divided into the following three:

a) tax payments (including actual taxes paid from profits and some other fiscal obligations);

b) payments on account of interest payments on the company's bonds and on loans, if the interest on them exceeds the established standard within the limits of this excess - settlements on a money loan;

c) payments for commercial loans, which are mostly hidden in relation to profits, but actually reduce the amount of profit remaining at the disposal of the enterprise, as prices in terms of deferred payment are almost always higher than prices with immediate or prepayment.

Издержки образуют отдельный денежный поток платежей из дохода предприятия, представляя собой часть валовой выручки, которая компенсирует расходы предприятия на ведение производственно-хозяйственной деятельности.

Управление * издержками составляет сущность пятой задачи финансового менеджмента, решение которой должно обеспечить прибыльность производственно-хозяйственной деятельности предприятия (в частных случаях - её минимальную убыточность, см. выше). Методическую основу решения данной задачи составляет управленческий учет и основанный на нем операционный анализ, которые предполагают:

Издержки разделяются на два денежных потока:

а) государству - в виде налогов и отчислений, которые согласно законодательству относятся на издержки производства, например отчисления в социальные внебюджетные фонды;

b) for servicing a cash loan, in the form of interest payments on loans within the established standard, repayment of loans and bonds of the company;

c) repayment of accounts payable.

В результате формирования последнего потока заемные средства предприятия уменьшаются в размере, соответствующем произведенным расчетам по кредитам, что в принципе приводит к сокращению объемов производственно-хозяйственной деятельности. Для исключения этого необходимо принять меры по восстановлению размера заемных средств по крайней мере до существовавших объемов, что требует от финансового менеджмента постоянных и непрерывных усилий по построению нормальных отношений с кредиторами. Сущность этих усилий совпадает с содержанием задач формирования рациональной финансовой структуры капитала и создания привлекательных условий для инвесторов (в данном случае кредиторов). Результатом этой работы является формирование следующего потока денежных средств, который окончательно замыкает финансовый оборот предприятия - поток новых заемных средств.

Решение частных задач финансового менеджмента представляет собой непрерывный циклический процесс, в котором решение каждой следующей задачи основано на решении предыдущей, а решение последней во многом определяет способы и качество решения первой. Кроме того, между решениями практически всех задач финансового менеджмента существуют обратные связи, что означает необходимость не изолированных, а комплексных решений на основе их взаимных корректировок. Эта особенность финансового менеджмента в совокупности с принципиальной нестабильностью внешней финансовой среды позволяет определить его как наиболее сложную подсистему общей системы управления предприятия.

Comments

To leave a comment

Management

Terms: Management