Lecture

After management has compared external threats and opportunities with internal strengths and weaknesses, it can determine the strategy * that it will follow. The organization faces several basic strategic alternatives, each of which is effective under certain conditions and the state of the internal and external environment. These alternatives include limited growth, growth, reduction, and a combination strategy.

Limited growth This strategy is used by most organizations in mature industries with stable technology. When a strategy of limited growth is characterized by setting goals from what has been achieved, adjusted for inflation. If management is generally satisfied with the position of the firm, then in the future it will adhere to the same strategy, since this is the simplest and least risky course of action.

Growth. Growth strategy * is carried out by a significant annual increase in the level of development above the level of the previous year (period). This strategy is most often used in dynamic industries with rapidly changing technologies. It can adhere to leaders seeking to diversify (the diversity of the product range) of their forms in order to leave the markets staying in stagnation. Growth can be internal or external. Internal growth can occur by expanding the range of products. External growth may be in related industries in the form of vertical or horizontal growth. Growth can lead to a merger of firms in unrelated industries.

Reduction, or last resort strategy. This strategy is chosen by the organization least. The level of goals pursued is set lower than what was achieved in the past. As part of an alternative reduction, there may be several options.

Combined strategy . This strategy is any combination of alternatives considered - limited growth, growth and reduction. The combined strategies are usually followed by large organizations that are active in several industries.

Each of the above strategies is a basic strategy, which, in turn, has many alternatives. Variants of basic strategies are checked for compliance with the goals of the organization, compared with the corresponding stages of the product life cycle, demand or technology, strategic objectives are formulated, deadlines for solving problems are established, and the required resources are determined.

The modern concept of strategic planning provides for the development of an organization’s strategy of using effective reception - strategic segmentation and the allocation of strategic economic zones (SZH). SZH - a separate segment of the external environment, to which the organization has or wants to get out.

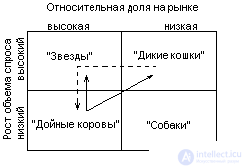

There are several methodological approaches to the planning of strategic alternatives and their evaluation. They can be used in a certain combination, depending on the task. A convenient tool for comparing the various strategic areas of management in which the organization and its business strategic divisions (CPS) will work is a special matrix developed by the Boston Consulting Group (BKG) (see Fig. 5.3). In it, to determine the prospects for the development of an organization, it is proposed to use a single indicator - the growth in demand . It sets the size of the growth vertically. The horizontal size is determined by the ratio of the market share belonging to its leading competitor.

The BCG matrix allows an organization to classify each of its CPS by its market share relative to its main competitors and the annual growth rate in the industry. The matrix is built on the premise that the greater the share of SHP in the market, the lower the unit costs and the higher the profit as a result of the relative savings in production volumes.

"Stars" occupy a leading position in the rapidly growing industry. They bring significant profits, but at the same time require significant amounts of resources to finance growth, as well as tight control over these resources by management. The Stars' * strategy is aimed at increasing or maintaining market share. As the industry slows down, the star turns into a cash cow.

“Cash cow” occupies a leading position in a relatively stable industry. The strategy of the “cash cow” is aimed at maintaining a substantial position for as long as possible and providing financial support to developing agricultural farms.

"Wildcat" has a weak market impact (small market share) in a growing industry. As a rule, it is characterized by weak customer support and unclear competitive advantages. The wildcat strategy has alternatives to intensifying the organization’s efforts in a given market or leaving it.

By "Dogs" are SHP with a limited volume of sales. Strategy * "dogs", is to weaken the efforts of the market or the elimination (sale).

In fig. 5.3. the dotted line indicates that “wild cats” may become “stars” under certain conditions.

Fig. 5.3. Matrix Boston Advisory Group.

With the advent of maturity, the “stars” will first become “milk cows” and then “dogs”. The solid line shows the redistribution of resources from the “milk cows”.

Foreign experience in using the BCG matrix has shown that it is very useful in determining strategic positions, as well as for distributing strategic resources for the near future. The BCG matrix is applicable only if volume growth can be a reliable measure of prospects (low level of environmental instability).

The MacKinsey matrix gives a more complete picture of the company's strategic position and its choice of strategic decisions; instead, the SZH attractiveness parameter is used instead of the volume growth indicator, and the future competitive status of the firm (CSF) instead of relative market share.

The strategic choice made by managers is affected by a variety of factors. Here are some of them.

Risk. What level of risk does the management consider acceptable?

Knowledge of past strategies. Often, consciously or unconsciously, leadership is influenced by past strategies.

Reaction to the owner. Quite often, stockholders limit the flexibility of management when choosing a strategic alternative.

Time factor. Implementing even a good idea at the wrong time can lead to the collapse of the organization.

Comments

To leave a comment

Management

Terms: Management