Lecture

A stabilization policy in an open economy is a government policy (a set of measures of state influence on the economy) aimed at (the goal of which is) ensuring double equilibrium — internal (defined, as a rule, as ensuring total output at full employment, i.e. at the level of potential GDP) and external (understood as the balance of payments balance). The types of stabilization policies are fiscal, monetary, foreign trade and monetary.

There are two types of open economies: small open economies and large open economies.

A small open economy means the economy of a country that is greatly influenced by the economies of other countries, but which has practically no effect on the economic development of other countries. At the same time, the value of the interest rate of a given country (R) is determined by the value of the world interest rate (R *), which is not affected by a change in the internal interest rate (regardless of the volume of financial operations of a given country in world financial markets). The difference between the global interest rate and the internal interest rate (interest rate differential) is the only factor determining the direction of capital flow.

A large open economy is an economy that has a significant impact on the development of the economies of other countries, determining the level of global interest rates and providing a significant share of international trade and financial transactions.

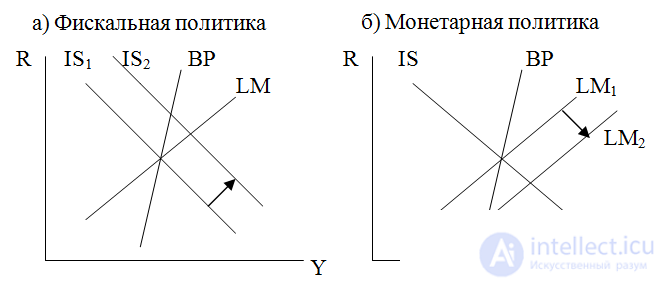

A stabilization policy in a small open economy To analyze the most effective ways to achieve the goal of achieving a double equilibrium in a small open economy, the Mandell-Fleming model proposed by Robert Mundell, a professor at Columbia University (USA), and Markus, an employee of the International Monetary Fund (IMF), was used in the early 60s. Fleming. The model was developed for the fixed exchange rate regime, but it is absolutely applicable for the floating exchange rate regime. The Mundell-Fleming model is a Keynesian-type model, developed on the basis of the IS-LM model, and examines the conditions for establishing double equilibrium in the short run. In the same way as the IS-LM model allows finding out the conditions for establishing internal balance and evaluating the effectiveness of various types of policies in a closed economy, the Mandell-Fleming model is used to assess the effects of monetary, fiscal and foreign trade policies in an open economy. To this end, it is necessary to supplement the IS-LM model of the balance of payments balance (BP - balance of payments). The balance of payments is in equilibrium if the sum of the current account balance (NX - net export) and the capital account balance (CF - capital flows) is zero.

BP = NX + CF = 0

The balance of payments curve has a positive slope, since income growth leads to an increase in imports (import function: Im = Im + mY, where Im is the value of autonomous imports, Y is the total income, m is the marginal propensity to import, which shows how much it will increase (decreases a) imports with an increase (decrease) in income per unit) and a current account deficit (negative net exports). To ensure a balance (zero balance) in the balance of payments, the current account deficit must be compensated for by an equal positive balance of the capital account. Capital inflows into the country can only be ensured if the internal interest rate rises. Excess domestic interest rate over world interest rate. means that the return on financial assets of a given country will be higher than in other countries and will make them more attractive to foreigners. Thus, a higher rate of interest must correspond to a higher level of income.

The slope of the BP curve depends on the slopes of the net export curve (NX) and the capital flow curve (CF). NX curve equation:

NX = Ex - Im - mY

where Ex is autonomous exports, Im is autonomous imports, m is the marginal propensity to import or, in other words, the sensitivity of changes in imports by changing income levels, Y is the value of total income. The slope of the NX curve is determined by the value of the coefficient of sensitivity of changes in imports by changes in income (m). The NX curve will be flatter if the parameter m is small, i.e. if imports are insensitive to changes in income. And, accordingly, the higher the sensitivity of imports to changes in income, the NX curve is steeper. CF curve equation:

CF = CF + c (R - R *)

where CF is the autonomous capital flow, R is the internal interest rate, R * is the world interest rate, c is the sensitivity of the change in the value of the capital flow by the change in the difference between the domestic and world interest rates. The slope of the CF curve is determined by the value of the coefficient c. The CF curve will be flatter if the sensitivity of the change in the value of the capital flow to the change in the difference between domestic and world interest rates is high, and more steep if the parameter is small.

BP equation:

BP = Ex - Im - mY + CF + c (R - R *) = 0

Thus, the slope of the BP curve is m / s. The flatter the NX curve (the smaller the coefficient m) and the flatter the CF curve (the larger the coefficient c), the flatter the BP curve. The main factor determining the slope of the BP curve is the degree of international capital mobility, characterized by the coefficient c. The higher the degree of international capital mobility (ratio with a large), the flatter the curve BP. This means that the sensitivity of changes in the magnitude of the flow of capital to the change in the difference between domestic and world interest rates is great, i.e. even a slight excess of the domestic rate of interest over the world will lead to a significant inflow of foreign capital into the country. If capital mobility is absolute, and this means that the financial assets of a given country are absolute substitutes for financial assets of other countries, then the BP curve has a horizontal view (the coefficient c is equal to infinity). If capital mobility is low (capital flows react poorly to the difference between domestic and world interest rates, i.e., the coefficient is small, and a very large increase in the internal interest rate is required to ensure the necessary inflow of foreign capital), then the BP curve is steep. If there is no international capital mobility (the degree of international capital mobility is 0), then the BP curve is vertical (coefficient с = 0).

The degree of international capital mobility has the most significant impact on the effectiveness of monetary policy in an open economy. A very important factor is also the exchange rate regime. There are two modes: 1) fixed exchange rate regime 2) floating exchange rate regime.

To evaluate the effectiveness of monetary policy in an open economy, we consider the impact of stimulating monetary policy under different exchange rate regimes and with different degrees of capital mobility, using the IS-LM model and assuming that the intersection point of the IS and LM curves correspond to the situation of domestic economic equilibrium, t. e. simultaneous equilibrium of commodity and financial markets. To analyze the external equilibrium, it is necessary to add a third curve to these two curves - the balance of payments balance BP. Suppose that initially the economy is in a state of internal and external equilibrium, i.e. all three curves intersect at one point.

Monetary policy in a small open economy with a fixed exchange rate regime.

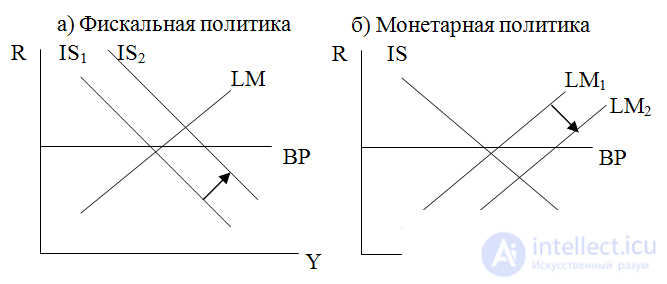

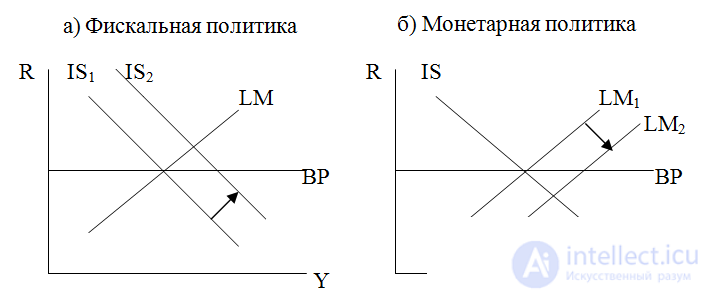

In conditions of low capital mobility (BP curve is steep). Initially, the economy is at point A. Increasing the money supply shifts the LM curve to the right. This will lead to a decrease in the interest rate and an increase in the income level to which the new point of internal equilibrium corresponds. Growth in the income level means an increase in imports and the appearance of a trade deficit. A reduction in the interest rate will cause an outflow of capital from the country, since its financial assets will become less profitable and less attractive to investors. The consequence will be a capital account deficit. As a result, the balance of payments will be negative, and the exchange rate of the national currency will decline. Financing the balance of payments deficit under a fixed exchange rate regime through interventions by the Central Bank depletes the country's foreign exchange reserves. Therefore, in order to maintain a constant exchange rate, the Central Bank reduces the supply of the national currency, increasing the demand for foreign. This measure will shift the LM curve to its original position. A reduction in the money supply will increase the interest rate, which will lead to a reduction in the value of the aggregate expenses that are sensitive to changes in the interest rate and to a multiplicative decrease in the level of total income. The economy will return to its original state, and the monetary impulse (will not affect the amount of income) will be in vain (is wasted), because as a result the amount of income has not changed (the effect on income is zero).

High capital mobility (flat BP curve). In contrast to the case of low capital mobility, when the BP curve is steeper than the LM curve, in conditions of high mobility, the BP curve is flatter than the LM curve. The growth of the money supply leads to the same consequences as in the case of low capital mobility - the LM curve shifts to the right, which increases the level of income and reduces the interest rate. The increased level of total income increases the demand for imports, which leads to a trade balance deficit, and a lower interest rate provokes outflow of capital abroad, causing the appearance of a capital account deficit. The balance of payments will be negative, which will lower the exchange rate of the national currency and will necessitate the intervention of the Central Bank, which will have to reduce the supply of the national currency and increase the supply of foreign currency in order to maintain the fixed rate of the national currency. The LM curve will shift to the left and will be in its original position. However, unlike the case of low capital mobility, this shift will happen faster. In addition, the same difference between domestic and global interest rates will lead to a greater outflow of capital, since the sensitivity of changes in capital flow to changes in the differential of interest rates is higher, that is, the coefficient c is greater (capital mobility is high), therefore the rate of exhaustion of foreign exchange reserves will be higher . (exhaustion of foreign exchange reserves will occur at a higher rate).

Perfect capital mobility (BP curve horizontal). In this case, the internal interest rate is equal to the world, which means that the financial assets of a given country are absolute substitutes for the financial assets of other countries. Even a slight excess of the domestic interest rate over the world, since the mobility of international capital is absolute, would attract all financial assets of other countries to that country, which is unacceptable in the global economy.

Stimulating monetary policy in conditions of absolute capital mobility has the same consequences and is just as ineffective as with a low and high degree of capital mobility. An increase in the money supply will lead to an increase in income and a reduction in the rate, and as a result to a deficit in the balance of payments and a decrease in the exchange rate of the national monetary unit, which will force the Central Bank to intervene and buy up the national currency to raise the exchange rate of its currency to the initial fixed level. This will shift the LM curve to its original position, and there will be no impact of monetary impulse on income.

However, the difference in the mechanism of influence of monetary policy in this case is that this situation is hypothetical. The economy cannot reach point B, since it is impossible to exceed the domestic rate over the world one in conditions of absolute capital mobility. An attempt by the Central Bank to simultaneously maintain a fixed exchange rate of the national currency and the new value of the money supply, given the need to finance the balance of payments deficit, will lead to a very rapid (almost immediate) exhaustion of foreign exchange reserves.

Monetary policy in a small open economy under a floating exchange rate regime. In contrast to the fixed exchange rate regime, in which the Central Bank, in order to finance the balance of payments deficit and maintain a constant exchange rate of the national currency, should reduce foreign exchange reserves and compress the money supply, the floating exchange rate regime means that the exchange rate is set by the market mechanism according to the ratio of the demand and supply of the national currency. In this case, the imbalance of the balance of payments is eliminated automatically, that is, the balance of payments is always zero and the economy is always on the BP curve. This is due to an automatic change in the exchange rate, which shifts the BP curve, and provides an external equilibrium situation in the economy. The appreciation of the national currency (appreciation), i.e. the growth of its exchange rate in relation to other currencies shifts the BP curve to the left, and its depreciation (depreciation), i.e. a decrease in the exchange rate shifts the BP curve to the right.

The balance of payments balance is achieved due to the fact that if the economy has a trade balance deficit, which corresponds to the point of internal equilibrium lying below the BP curve, and, consequently, lower than the world interest rate. A low interest rate means that capital outflow will begin to occur from the country, which will reduce the demand for national currency and lower the exchange rate of the national currency. This will make the goods of this country relatively cheaper for the Inratrans and increase exports. At the same time, imported goods are relatively more expensive, since the citizens of this country will have to give out a greater amount of national currency in exchange for foreign in order to buy the same amount of goods, which will reduce imports. As a result, net exports will increase and the trade deficit will disappear.

Similarly, if the trade balance is positive, then the equilibrium point will be above the BP curve, which corresponds to a higher than world level of the internal interest rate, i.e. financial assets of a given country will have higher returns than financial assets of other countries. Capital will flow into the country, which will increase the demand for national currency and increase its exchange rate. The growth of the exchange rate will make the goods of this country relatively more expensive and will reduce exports, and imported goods relatively cheaper, which will increase the volume of imports. As a result, net exports will shrink, and the trade surplus will disappear.

Low capital mobility. The increase in money supply will shift the LM curve to the right, which will result in a higher level of income and therefore an increase in imports, which will lead to a trade balance deficit. However, a decrease in the national interest rate below the world one as a result of monetary expansion will cause an outflow of capital from the country, which will make the balance of payments deficit. With the floating exchange rate regime, the elimination of the balance of payments deficit occurs due to a decrease in the exchange rate, so the BP curve will shift to the right. The depreciation of the national currency will lead to an increase in net exports, which will cause the IS curve to shift to intersection with the LM and BP curves. Thus, under the floating rate regime, monetary policy becomes effective. The reduction in the national interest rate as a result of monetary expansion has a stimulating effect not only on the internal components of aggregate demand, but also causing a decline in the exchange rate of the national currency, increasing external demand.

High capital mobility. In this case, the effectiveness of monetary policy increases. Capital is more responsive to a decrease in the internal interest rate, and therefore capital outflow is more significant than in conditions of low capital mobility, which leads to a greater deficit in the balance of payments and the need for a more significant reduction in the value of the national currency. Exports are growing more, so the increase in income is greater. Perfect capital mobility. In conditions of perfect capital mobility, the effectiveness of monetary policy is maximum. A decrease in the national interest rate as a result of a shift in the LM curve leads to an outflow of capital, and an increase in income leads to an increase in imports, which leads to a balance of payments deficit. The depreciation of the national currency stimulates net exports, and the IS curve shifts to the right until the equality of the national global interest rate is restored. Income increases to the maximum extent. A feature of this case, in contrast to the conditions of low and high capital mobility, is that 1) the BP curve does not shift and 2) the monetary impulse affects only net exports without affecting the internal components of aggregate demand.

However, the depreciation of the national currency, the growth in net exports and the growth in output and employment as a result of monetary expansion in one country means a simultaneous deterioration in the trade balance in other countries. The depreciation of the national currency leads to the fact that domestic goods become relatively cheaper, while imported goods become relatively more expensive, which shifts demand from foreign goods to domestic ones. As a result, imports are declining, and output and employment in other countries are falling. Therefore, such a policy was called the policy of “neighbor robbery”.

Thus, the effectiveness of monetary policy in a small open economy depends on the exchange rate regime and on the degree of capital mobility. In the conditions of a fixed exchange rate, a stimulating monetary policy, regardless of the degree of capital mobility, does not affect the level of income and interest rate, i.e. is ineffective. A change in the money supply is an endogenous value and is subordinated to the task of ensuring a constant exchange rate. The central bank cannot control the money supply, i.e. can not conduct an independent monetary policy, its activities are aimed only at ensuring the fixed exchange rate, in order to stop the depreciation of the national currency, caused by lower interest rates.

Under conditions of floating exchange rates, monetary policy in a small open economy becomes effective. Moreover, the higher the degree of capital mobility, the more the income increases, i.e. the effectiveness of monetary policy is higher. Under these conditions, the Central Bank is able to conduct an independent monetary policy, is able to control the amount of money supply, and the growth in the money supply becomes an exogenous value.

Fixed exchange rate

Low capital mobility

Fixed exchange rate

High capital mobility

Fixed exchange rate

Perfect capital mobility

Floating exchange rate

Low capital mobility

Floating exchange rate

High capital mobility

Floating exchange rate

Perfect capital mobility

Comments

To leave a comment

Macroeconomics

Terms: Macroeconomics